loaboston.site Market

Market

Icln Fund

Get iShares Global Clean Energy ETF (ICLN:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. What is ICLN? The iShares S&P Global Clean Energy Index Fund seeks investment results that correspond generally to the price and yield performance before fees. The Fund seeks to track the investment results of the S&P Global Clean Energy Index, which is designed to track the performance of approximately clean. This ETF is a fund, created in June , that corresponds to the price and yield performance, before fees and expenses, of the Standard & Poor's Global Clean. The index is designed to track the performance of approximately clean energy-related companies. The fund generally invests at least 80% of its assets in. ICLN is a thematic ETF tracking the S&P Global Clean Energy Index. Despite poor returns to start off , ICLN may offer a short-term opportunity for investors. This fund offers a way to invest in the global clean energy index, including both domestic and international stocks in its portfolio. Get the latest iShares Global Clean Energy ETF (ICLN) real-time quote, historical performance, charts, and other financial information to help you make more. The fund invests in stocks of companies operating across utilities, independent power and renewable electricity producers, renewable electricity, alternative. Get iShares Global Clean Energy ETF (ICLN:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. What is ICLN? The iShares S&P Global Clean Energy Index Fund seeks investment results that correspond generally to the price and yield performance before fees. The Fund seeks to track the investment results of the S&P Global Clean Energy Index, which is designed to track the performance of approximately clean. This ETF is a fund, created in June , that corresponds to the price and yield performance, before fees and expenses, of the Standard & Poor's Global Clean. The index is designed to track the performance of approximately clean energy-related companies. The fund generally invests at least 80% of its assets in. ICLN is a thematic ETF tracking the S&P Global Clean Energy Index. Despite poor returns to start off , ICLN may offer a short-term opportunity for investors. This fund offers a way to invest in the global clean energy index, including both domestic and international stocks in its portfolio. Get the latest iShares Global Clean Energy ETF (ICLN) real-time quote, historical performance, charts, and other financial information to help you make more. The fund invests in stocks of companies operating across utilities, independent power and renewable electricity producers, renewable electricity, alternative.

Get iShares Global Clean Energy ETF (ICLN:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Complete iShares Global Clean Energy ETF funds overview by Barron's. View the ICLN funds market news. iShares Global Clean Energy ETF ICLN has a carbon footprint of tonnes CO2 / $1M USD invested. The iShares Global Clean Energy ETF (ICLN) seeks to track the investment results of an index composed of global equities in the clean energy sector. ICLN. iShares Global Clean Energy ETF. Fact Sheet as of Jun The iShares Global Clean Energy ETF (ICLN) seeks to track the investment results of an. The Fund seeks to track the investment results of the S&P Global Clean Energy Index, which is designed to track the performance of approximately clean. iShares Global Clean Energy ETF ICLN seeks to track the performance of the S&P Global Clean Energy Index, which contains stocks of companies involved in clean. Assess the ICLN stock price quote today as well as the premarket and after hours trading prices. What Is the iShares Global Clean Energy Ticker Symbol? ICLN is. Analysis of the iShares Global Clean Energy ETF ETF (ICLN). Holdings, Costs, Performance, Fundamentals, Valuations and Rating. Looking to buy ICLN ETF? View today's ICLN ETF price, trade commission-free, and discuss iShares Global Clean Energy ETF updates with the investor. Fund Owner Firm Name. Prospectus Benchmark Index. S&P Global Clean Energy NR USD, %. Broad Asset Class Benchmark Index. %. Manager Tenure. Greg Savage. iShares Global Clean Energy ETF ICLN has $ MILLION invested in fossil fuels, 15% of the fund. An easy way to get iShares Global Clean Energy ETF real-time prices. View live ICLN stock fund chart, financials, and market news. Latest iShares Global Clean Energy ETF (ICLN:NMQ:USD) share price with interactive charts, historical prices, comparative analysis, forecasts. View the latest iShares Global Clean Energy ETF (ICLN) stock price and news, and other vital information for better exchange traded fund investing. Find the latest quotes for iShares Global Clean Energy ETF (ICLN) as well as ETF details, charts and news at loaboston.site ICLN - iShares Global Clean Energy ETF - Stock screener for investors and traders, financial visualizations. ICLN Mutual Fund Guide | Performance, Holdings, Expenses & Fees, Distributions and More. iShares ICLN ETF (iShares Global Clean Energy ETF): stock price, performance, provider, sustainability, sectors, trading info. Get the latest iShares S&P Global Clean Energy Index Fund (ICLN) fund price, news, buy or sell recommendation, and investing advice from Wall Street.

Budget Ap

Introduction · Economic Analyses · Special Analyses and Presentations · Management Priorities · Technical Budget Analyses · Detailed Functional Tables · Federal. This section provides budget documents of Andhra Pradesh for different years. These documents incorporate data on both expenditure and receipts of the State. GOVERNMENT OF ANDHRA PRADESH · Vote on Account · · · · · · Vote on Account · The federal workforce is growing, as House appropriators consider agency spending cuts. Despite a growing federal workforce, current budget deliberations in. Rocket Money: Best for those who are looking to cut down on their monthly costs. Formerly known as Truebill, Rocket Money is a budgeting app that serves more. Explore the latest budgets and find out how they help financial aid officers develop living expense budgets for independent, off-campus students. A budgeting app can be a quick fix to getting your finances back on track. Certify AP has a large set of reports which enable administrators and managers to analyze spend data. The Budget vs. Actual Report is a. Login Here · Budget Manual · User Manuals · Help Desk. Introduction · Economic Analyses · Special Analyses and Presentations · Management Priorities · Technical Budget Analyses · Detailed Functional Tables · Federal. This section provides budget documents of Andhra Pradesh for different years. These documents incorporate data on both expenditure and receipts of the State. GOVERNMENT OF ANDHRA PRADESH · Vote on Account · · · · · · Vote on Account · The federal workforce is growing, as House appropriators consider agency spending cuts. Despite a growing federal workforce, current budget deliberations in. Rocket Money: Best for those who are looking to cut down on their monthly costs. Formerly known as Truebill, Rocket Money is a budgeting app that serves more. Explore the latest budgets and find out how they help financial aid officers develop living expense budgets for independent, off-campus students. A budgeting app can be a quick fix to getting your finances back on track. Certify AP has a large set of reports which enable administrators and managers to analyze spend data. The Budget vs. Actual Report is a. Login Here · Budget Manual · User Manuals · Help Desk.

Need a better money plan? With the free EveryDollar budget app, you'll save money, pay off debt, enjoy the things you love and take control of your. Through the simulation, students will learn the importance of the budgeting process and that decisions concerning how our government spends its money form the. Uncover financial budget importance. Explore the definition, types, and real-world examples of financial budgets to enhance your financial planning. 1. General Administration Department. 2. Andhra Pradesh Public Service Commission. 3. Tribunal for Disciplinary Proceedings. 4. Anti Corruption Bureau. Rated 5 stars and loved by thousands of users! Unlike traditional complicated budgeting apps, Daily Budget Original focuses on being simple. Get our free car rental app. Rent a car from your mobile device quickly and easily by downloading the Budget Car Rental app that works for your device. The office offers institutional partners guidance and expertise in capital planning, budgeting, administration of the UW Managed design and construction program. The required Hard and Soft copies of A.P. Municipal. Accounting Manuals will be provided by Centre for Good Governance, Hyderabad. 4. Commissioner and Director. Define A&P Budget. shall have the meaning set forth in Section The Office of Capital Planning and Budget provides support to the Board of Regents, the 13 institutions of UW System and, in partnership with the Wisconsin. Personal and household budgeting system for the Web, Android and iPhone. Keep track of money to spend, save, and give toward what's important in life. AP Finance Website,Finance Website,Finance Department,APCFSS,Finance. We have the present accounting classification with effect from the Budget for as prescribed by the Controller General of Accounts in consultation with. In , total receipts (excluding borrowings) are estimated to fall short of the budget estimate by Rs 43, crore (a shortfall of 27%). Revenue deficit. Say hello to your new financial companion, Buddy. The joyful budgeting app. Outgoing Wire Transfers; Stop Pay Requests; Utility Services & Other Vendor Payments. Budget & Cost Records. Contact our Team. Appendix, Budget of the United States. Government, Fiscal Year contains detailed in- formation on the various appropriations and funds that constitute the. Picking the right budgeting app isn't a universal experience. Everyone has a different financial situation, so a budgeting app that's perfect for one person. But what are those factors? Capital asset budget, cash collections schedule, cash payments schedule, cash budget, and budgeted balance sheet. Capital asset. Some Advanced Placement (AP), International Baccalaureate (IB), and Cambridge. International Education (CIE) teachers will qualify for bonus pay in January.

Do You Have To Pay For A Credit Card

Many credit cards charge a fee every year just for having the card. Annual fees typically range from $95 to upwards of $ Most cards charge the same fee. When do we apply specific transactions, fees, and credits to your Account? Part 4: Making and Processing Payments. How much do you need to pay by the Payment. For those situations, it can be OK to only pay the minimum — but not long term. Once you have the funds available to cover your balance, pay it off in full. At. You're not alone. Credit cards offer easy access to funds. Debt can rack up fast, especially if life throws you an unexpected curve. 1 in 10 credit card holders. When used responsibly, a credit card can make you money. Other times, it can cost you. Visit Citizens to learn about the costs of using a credit card. Credit cards allow you to make a minimum payment that's a small percentage of the total balance. You must pay at least the minimum to avoid late fees, an. Just pay it off in full every month and it's free rewards. The only way to lose on a no annual fee card is if you don't pay it off in full. If you're under financial stress and can't afford to pay your credit card balance in full, it's best to pay as much as you can each month. Any amount will help. Some credit card companies will charge an annual fee, but the card will typically have special benefits that justify a fee being charged. Many credit cards charge a fee every year just for having the card. Annual fees typically range from $95 to upwards of $ Most cards charge the same fee. When do we apply specific transactions, fees, and credits to your Account? Part 4: Making and Processing Payments. How much do you need to pay by the Payment. For those situations, it can be OK to only pay the minimum — but not long term. Once you have the funds available to cover your balance, pay it off in full. At. You're not alone. Credit cards offer easy access to funds. Debt can rack up fast, especially if life throws you an unexpected curve. 1 in 10 credit card holders. When used responsibly, a credit card can make you money. Other times, it can cost you. Visit Citizens to learn about the costs of using a credit card. Credit cards allow you to make a minimum payment that's a small percentage of the total balance. You must pay at least the minimum to avoid late fees, an. Just pay it off in full every month and it's free rewards. The only way to lose on a no annual fee card is if you don't pay it off in full. If you're under financial stress and can't afford to pay your credit card balance in full, it's best to pay as much as you can each month. Any amount will help. Some credit card companies will charge an annual fee, but the card will typically have special benefits that justify a fee being charged.

Of course, you should only do this if you know you can pay off the balance each month. To make sure your credit card spending doesn't get out of hand, never. Many credit card companies may be willing to help if you're facing a financial emergency. You do not need to be behind on your payments to ask for help! Don. Interest is what you pay for using someone else's money. You repay money to whoever gave you the credit card or loan. Credit cards and loans have different. Note. Credit cards can be secured or unsecured. A secured credit card requires a cash deposit to open, which typically doubles as your credit limit. Credit cards are essentially financing. You are borrowing money to pay for whatever you are purchasing with a credit card. The payment is due at the end of the. Just pay it off in full every month and it's free rewards. The only way to lose on a no annual fee card is if you don't pay it off in full. Late fees: In most cases, you must pay off charge cards in full every month. Carrying a balance might result in a significant late fee or other penalties. And. You finally used your credit card for a big purchase you've had your eye on, but now you're wondering if you should pay your credit card balance off in full. Your best strategy is to use your credit cards and pay off the bill in full each month, so you keep your overall debt-to-credit limit ratio low. 7. Fact: Having. With a credit card, you borrow money to buy something now. Later you pay back the money, usually with interest. Some people use a credit card to buy things they. Credit cards offer a fast, convenient way to pay in person or online. A transaction occurs when your credit card issuer and the merchant's bank exchange. After that, if you do not pay the full balance on time interest may be added to the account. Some cards offer a special deal where you are not charged interest. As a general rule, credit cards work by charging you in two ways. Interest is charged as a percentage of the money you've borrowed. But the rate can also vary. With a credit card, you can earn rewards, pay for travel, and enjoy other benefits. Having a credit card, however, can be pricey if you fail to make your. When you pay with your TwinStar Visa® debit card at a check-out counter, you often have a choice between running your card as debit or credit. When you swipe a credit card to pay for an item, you don't get charged right at that moment; rather, you get a bill from your bank at the end of month and you. The minimum payment due is the minimum amount that must be paid to keep your account current. If you make only the minimum payment each period, you'll pay more. When you use a credit card, you're borrowing money from the credit card issuer and adding to a balance that you can pay off each month or carry while paying. Late Payment Warning: If we do not receive your minimum payment by the date listed above, you may have to pay a $35 late fee and your APRs may be increased up. This money is not a loan, and no interest is charged. You will not have to make any minimum monthly payments. However, you must be careful not to charge more.

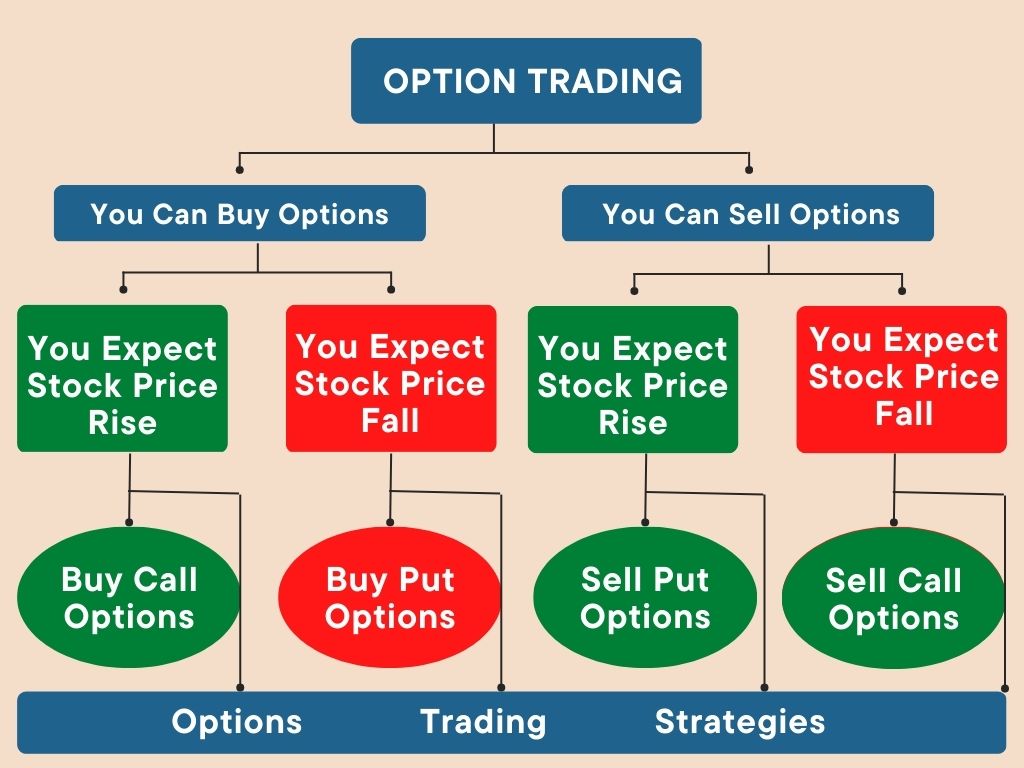

Options Investor

There are 2 major types of options: call options and put options. Both kinds of options give you the right to take a specific action in the future, if it will. Learn about the two option types available to investors: calls and puts. Find out more about options trading with an Ameriprise Financial advisor. What are options? An option is a contract that represents the right to buy or sell a financial product at an agreed-upon price for a specific period of time. Learn about options. They can be part of sophisticated strategies for experienced investors to help lock in market gains, protect against loss or generate. Buying a call option bets on “more.” Selling a call bets on “less.” Here are 3 examples of call options trading. Updated Aug 26, · 8 min read. Options trading on Robinhood. Plus advanced charts, no contract fees, and some of the lowest margin rates in the industry. Options are a type of contract that gives the buyer the right to buy or sell a security at a specified price at some point in the future. These steps may help you go from being approved to trade options to actually placing your options trade. IBD's extensive futures and options coverage tells you what you need to know about the gold and oil markets. Also find trading tips during earnings season. There are 2 major types of options: call options and put options. Both kinds of options give you the right to take a specific action in the future, if it will. Learn about the two option types available to investors: calls and puts. Find out more about options trading with an Ameriprise Financial advisor. What are options? An option is a contract that represents the right to buy or sell a financial product at an agreed-upon price for a specific period of time. Learn about options. They can be part of sophisticated strategies for experienced investors to help lock in market gains, protect against loss or generate. Buying a call option bets on “more.” Selling a call bets on “less.” Here are 3 examples of call options trading. Updated Aug 26, · 8 min read. Options trading on Robinhood. Plus advanced charts, no contract fees, and some of the lowest margin rates in the industry. Options are a type of contract that gives the buyer the right to buy or sell a security at a specified price at some point in the future. These steps may help you go from being approved to trade options to actually placing your options trade. IBD's extensive futures and options coverage tells you what you need to know about the gold and oil markets. Also find trading tips during earnings season.

The Intelligent Option Investor is the hands-on guide to using a cuttingedge valuation framework in the fast-paced options market to boost growth, protect gains. investment advice. Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of. Option Care Health is the nation's largest independent provider of home and alternate site infusion services. IBD's Options Trading Online Courses teaches you the skills to succeed in options trading, from the basics to trading strategies and spread trading. Options are contracts giving the purchaser the right – but not the obligation -- to buy or sell a security at a fixed price within a specific period of time. Options Investing Pro. Analyst Calls · Pro Stock Picks · Pro Analysis · Pro Talks · Macro Insights for Investing · Business Day Episodes · Interviews. Options. Home · Investing; Options. The latest. Options Trading for the Conservative Investor: Increasing Profits Without Increasing Your Risk [Thomsett, Michael C.] on loaboston.site Investor Education Resources: Get answers to options questions via email or live chat with professionals. Learn about options advantages for investors. Trade options with zero-commissions and per-contract fee of just $ Use options chains to trade directly from the bid, ask and midpoint prices. Learn what options are and how options trading works. See the different types of options, terms to know, and potential strategies for investors. Options trading at Fidelity lets you pursue market opportunities intelligently. Apply to trade options. Options trading strategies use a variety of options trades, including put writing, options spreads, options-based hedged equity, and collar strategies. typically, a binary options Internet-based trading platform will ask a customer to deposit a sum of money to buy a binary option call or put contract. For. making options trading more accessible, fred tomczyk chief executive officer · Derivative Market Intelligence · Empowering Retail Investors Creates Powerful. With options trading, you gain the right to either buy or sell a specific security at a locked-in price sometime in the future. Options: Calls and Puts · An option is a derivative, a contract that gives the buyer the right, but not the obligation, to buy or sell the underlying asset by a. Try out an intuitive options-trading service that's integrated into your Fidelity trading experience. Start your free trial. Franklin Managed Options Strategies offer investors access to specialized, risk-managed investment capabilities. Investors can implement custom options. NYSE Options Markets. The NYSE operates two options markets: NYSE American Options and NYSE Arca Options. NYSE options markets have been in business for over

Get Cash From Your Credit Card

Generally speaking, you can withdraw anywhere from $ to 30% of your credit limit through a cash advance. The amount of cash you request — plus the cash. Your Regions credit card may be used for cash advance. Visit our online FAQs page for more information on cash advance fees and interest rates. Withdraw from an ATM · Insert your credit card or use a cardless ATM option to access your account. · Enter your credit card PIN. · Select the cash advance or. If you're a caisse or credit union member and an AccèsD or Desjardins mobile services app user, you can make cash advances online or on your mobile app. Log. Simply Put! Yes you can get a Cash Advance with a Credit Card in most Cases! But The only Problem with that is there is Almost Always a. Ways to get an advance · ATM Withdrawal. Request a PIN number for your credit card by contacting us directly and you can use your credit card to withdraw cash at. Credit Card use at: ATM; Bank teller; Wells Fargo Online (loaboston.site) or through the Wells Fargo mobile app. Cash-like transactions, such. How do I know the amount of my cash credit line? Look at your most recent credit card statement and find your Cash Advance Limit. Keep in mind, sometimes ATMs have additional limits. You also must have. Generally speaking, you can withdraw anywhere from $ to 30% of your credit limit through a cash advance. The amount of cash you request — plus the cash. Your Regions credit card may be used for cash advance. Visit our online FAQs page for more information on cash advance fees and interest rates. Withdraw from an ATM · Insert your credit card or use a cardless ATM option to access your account. · Enter your credit card PIN. · Select the cash advance or. If you're a caisse or credit union member and an AccèsD or Desjardins mobile services app user, you can make cash advances online or on your mobile app. Log. Simply Put! Yes you can get a Cash Advance with a Credit Card in most Cases! But The only Problem with that is there is Almost Always a. Ways to get an advance · ATM Withdrawal. Request a PIN number for your credit card by contacting us directly and you can use your credit card to withdraw cash at. Credit Card use at: ATM; Bank teller; Wells Fargo Online (loaboston.site) or through the Wells Fargo mobile app. Cash-like transactions, such. How do I know the amount of my cash credit line? Look at your most recent credit card statement and find your Cash Advance Limit. Keep in mind, sometimes ATMs have additional limits. You also must have.

You can use your credit card to get cash. Insert your credit card into an ATM, enter your PIN, choose the cash advance option, and enter your withdrawal. Next, you'll choose the “cash withdrawal" or “cash advance" option and enter the amount of cash you'd like to receive. Once you've selected your amount and made. Online. The fastest way to apply. Secure Online Apply now · In person. Visit a TD Bank near you to apply. Find a TD Bank · By phone. Talk to a Banking Specialist. Then, make an Instant Transfer: Go to your card info: On iPhone: open the Wallet app, tap your Apple Cash card, tap the More. Getting a cash advance from an ATM usually requires your physical card, as well as a personal identification number (PIN) provided by your card issuer. You. The transaction is processed similarly to a standard credit card purchase and you can complete the request online or at an RBFCU ATM. Unlike a cash withdrawal. With the Bank of America® Customized Cash Rewards credit card, earn 3% cash back in the category of your choice, 2% at grocery stores, and 1% on all other. Then choose “cash advance” on the ATM screen. The ATM may also charge you withdrawal fees if it belongs to a financial institution that's not part of your card. For example, if the highest interest rate on your account applies to the cash The bank is not giving me enough time to make the payment on my credit card. You can use your USAA credit card at most physical bank branches that perform this type of transaction. A cash advance fee from USAA would apply, which is. Here's a tip on how to take cash from your credit card · Create the account and link your checking account to receive funds. · Make an invoice. They essentially act as a short-term loan and can be accessed by withdrawing cash at an ATM with your credit card's PIN number, by requesting one in-person at. How do I get a cash advance from my credit card or line of credit? · Select Transfer & pay at the top of the page, then choose Internal transfers. · Choose the. If you use an in-network ATM to withdraw cash with your debit card, the transaction will be free. If you're in a pinch and use an out-of-network ATM, you'll. If you do decide to get a cash advance, the most common way is to access the money through an ATM. Simply insert your card, enter your PIN, and select the. Yes! Discover Card provides quick and easy options to get cash anytime and anywhere. You can get cash with your Discover card in three easy ways: (1) cash. ATM Withdrawal. You can get cash from your credit card at an ATM. You will need a PIN (Personal Identification Number) for your credit card, which you can. Fees will apply when using your credit card at any ATM to perform a cash advance or when using a credit card to withdraw cash. See the Deposit Account Rules. Digital payment services like Venmo and PayPal are great ways to get a cash advance without a pin. Link your credit card to your digital account, and the funds. When you withdraw cash at an ATM using your credit card, however, the cash is pulled from your credit line instead of your bank account.