loaboston.site Market

Market

Where Can U Donate Plasma For Money

Visit one of our local centers and earn money each time you donate. Sign up today to become a plasma donor and schedule your next donation appointment. This automated donation collects only the plasma and returns the remaining blood components to the donor. The actual donation takes 40 minutes, making the. New plasma donors can earn over $ during the first 35 days! In addition to getting paid for each plasma donation, you can make even more money during. Blood donation near you at a donor center or on the Big Red Bus. Give blood or platelets today to help save lives tomorrow. donating plasma. Avoid fatty foods and snacks prior to your donation. These foods can negatively effect blood tests which could prevent you from donating that. Because plasma is such a precious resource and because we know that giving takes both time and effort, our KEDREWARDS program offers compensation for donations. Donate Plasma for money, because plasma is such a valuable asset in the medical world, Olgam Life offers financial reimbursement at our plasma donation. Make a difference by donating plasma at ABO Plasma Collection Centers. Donating plasma can save lives—join us today and be rewarded for your contribution! A Cell Therapy Blood (Whole Blood) collection or Leukocytes (Buffy Coat) collection takes approximately 1 – 2 hours. Donors are compensated starting at $ Visit one of our local centers and earn money each time you donate. Sign up today to become a plasma donor and schedule your next donation appointment. This automated donation collects only the plasma and returns the remaining blood components to the donor. The actual donation takes 40 minutes, making the. New plasma donors can earn over $ during the first 35 days! In addition to getting paid for each plasma donation, you can make even more money during. Blood donation near you at a donor center or on the Big Red Bus. Give blood or platelets today to help save lives tomorrow. donating plasma. Avoid fatty foods and snacks prior to your donation. These foods can negatively effect blood tests which could prevent you from donating that. Because plasma is such a precious resource and because we know that giving takes both time and effort, our KEDREWARDS program offers compensation for donations. Donate Plasma for money, because plasma is such a valuable asset in the medical world, Olgam Life offers financial reimbursement at our plasma donation. Make a difference by donating plasma at ABO Plasma Collection Centers. Donating plasma can save lives—join us today and be rewarded for your contribution! A Cell Therapy Blood (Whole Blood) collection or Leukocytes (Buffy Coat) collection takes approximately 1 – 2 hours. Donors are compensated starting at $

Bloodworks Northwest is a volunteer donor supported organization and does not pay for blood or plasma donations. The amount of money you make for each successful plasma donation is based on the time it takes you to donate and other factors. Additionally, donor fees may. At Freedom Plasma, we honor our service members, veterans, and first responders. Your service helps to keep our communities safe and healthy. Get paid for your plasma donation and earn extra with bonuses and referrals. The more often you donate, the higher your donation payment. Plasma donations generally involve compensation. It takes about 90 minutes to donate plasma, and you should expect to be there for at least two hours. Become a plasma donor and help save lives while earning money at ADMA BioCenters · Donate Plasma · New donors! · Additional $10 Bonus on Your 2nd Plasma Donation. NY Blood Center offers you points which you can exchange for various gift cards, but no cold hard cash. The Specialized Donor Program is looking for healthy participants to give a variety of collections — including white blood cells – called Leukopaks. How Much Do You Get Paid for Plasma in NYC? · You can expect to earn $$50 per donation · The more you weigh, the more you can donate. Generally, heavier people. Donor safety, as well as the safety of the therapies made from plasma donations is of primary importance. You will need to visit a plasma collection center to. Join our donor recognition program! With as few as two plasma donations, you can redeem points for electronically delivered gift cards to restaurants, movie. Donate Plasma for money, because plasma is such a valuable asset in the medical world, Olgam Life offers financial reimbursement at our plasma donation. You can get paid to make a difference! PSG pays qualified donors a minimum of $ per plasma donation. PSG Donors is a blood and plasma donation center in. Each donor accepted into our program will earn up to $ for each successful plasma donation they are requested to make. Take the next step towards Plasma. Donating plasma takes time and commitment. To help ensure a safe and adequate supply of plasma, donors are provided with a modest stipend to recognize the. The need for plasma and plasma donors is more urgent than ever before. Visit loaboston.site to learn more and to find a donation center near you. You can expect to be paid anywhere from $20 to $50 per donation. The range in compensation is related to the volume of plasma you're able to. Donor. Earn money donating plasma If you are taking or have taken these medications, you may not be eligible to donate PLASMA, whole blood, or platelets. When you make a plasma donation, you donate approximately two to three times the amount of plasma than can be obtained from a whole blood donation. A. Get paid for your plasma donation and earn extra with bonuses and referrals. The more often you donate, the higher your donation payment.

Best Lottostar Game To Play

Play Crystopia now on loaboston.site with multipliers, wilds and scatters. All symbols can be split into 2 or 4 symbols with additional ways to win. Start with the demo version if you're new to Hot Hot Fruit Lottostar. This lets you get a feel for the game without risking real money. It's a great way to. Get transported into the Oriental world with our exciting Chinese-themed game, 5 Lucky Lions. You could win an instant payout of up to R20 Million in our Reel. Players can bet on the outcome of Italy's SuperEnaLotto, EuroMillions, Africa Millions, Kino 10, Kino 12, Kino 14, and Kino 16 games. A few of the additional. Get transported into the Oriental world with our exciting Chinese-themed game, 5 Lucky Lions. You could win an instant payout of up to R20 Million in our Reel. best deposit bonuses, free spins offers and no deposit bonuses Hot Hot Fruit by Habanero Games is classed as a high-volatility online slot game. LottoStar offers Live Games from Evolution & Ezugi providers. Play Live Blackjack, Poker, Roulette, Game Shows, Bollywood First Person Games, Baccarat & Sic. Play Free Bet Blackjack on loaboston.site Achieve a higher card count than the dealer but without going over 21 & WIN instant payouts with our Live Games. Play Wild Pups now on loaboston.site SPIN the NEON WHEEL to collect amazing wins. WILD symbol replaces any symbol except the scatter. Quick Games. Play Crystopia now on loaboston.site with multipliers, wilds and scatters. All symbols can be split into 2 or 4 symbols with additional ways to win. Start with the demo version if you're new to Hot Hot Fruit Lottostar. This lets you get a feel for the game without risking real money. It's a great way to. Get transported into the Oriental world with our exciting Chinese-themed game, 5 Lucky Lions. You could win an instant payout of up to R20 Million in our Reel. Players can bet on the outcome of Italy's SuperEnaLotto, EuroMillions, Africa Millions, Kino 10, Kino 12, Kino 14, and Kino 16 games. A few of the additional. Get transported into the Oriental world with our exciting Chinese-themed game, 5 Lucky Lions. You could win an instant payout of up to R20 Million in our Reel. best deposit bonuses, free spins offers and no deposit bonuses Hot Hot Fruit by Habanero Games is classed as a high-volatility online slot game. LottoStar offers Live Games from Evolution & Ezugi providers. Play Live Blackjack, Poker, Roulette, Game Shows, Bollywood First Person Games, Baccarat & Sic. Play Free Bet Blackjack on loaboston.site Achieve a higher card count than the dealer but without going over 21 & WIN instant payouts with our Live Games. Play Wild Pups now on loaboston.site SPIN the NEON WHEEL to collect amazing wins. WILD symbol replaces any symbol except the scatter. Quick Games.

Even the worst slots, only hold 20% of the money deposited. Meaning they have a 20% house edge. Lottery games hold about 50% usually. Never play. Enjoy LottoStar's Arcade Games like Maverick, Aviator, Maverick X, Mines, Crash X, Plinko Go & many more. Play now to relive the joy of your nostalgic. Set off on an adventure into the empirical city of ancient China in our exciting Ways of Fortune Reel Rush Game. Win maximum payouts of up to R20 Million. LottoStar: Looking for Quick Games to play online? Try our ScratchCards and some of our Top Games like Aviator, Moonshine, Mega Top Shot, Chest Hunter and. Play Top Shot now on loaboston.site WILD symbol replaces all other symbols except the Top Shot scatter symbol. All wins pay from left to right. Play Top Shot now on loaboston.site WILD symbol replaces all other symbols except the Top Shot scatter symbol. All wins pay from left to right. Air Dice is now a top Dice Game supplier for the Belgian online casino market and a household name in the global dice game vertical. Play Book of Riches on loaboston.site Spin the reels on our Reel Rush Games for payouts of up to R20 Million. No time to relax Guys I've found new secret of Spinazonke Game settings I know I always charge but Stop wasting your money playing. Random Reels: LottoStar introduces our new Quick Game with triple 7, watermelon, grapes, strawberries and many other symbols. Get the correct combinations. Immortal Ways Lottostar slot online for free in demo mode. Play free casino games, no download and no registration required. Golden Unicorn is a fairy tale-inspired game with wild bonuses, free spins, scatter symbols and many other amazing features. Play The Big Deal now on loaboston.site The male player with cards-in-hand symbol substitutes all other symbols except the scatter. SPIN & WIN great. Jackpot Slots Game All new users can get 20Free Play Instant Cashout and Best Service True redemption Up to % deposit bonus promotion. Top GamesSlotteriesLotteries · Arcade Games By playing this game you agree to the Terms and Conditions. The visual and. Reel Rush. Reel Rush. Reel Rush. Top Games. Habanero. Ruby. Red Rake. Privé. 1x2 Gaming. Jackpot Race. Top Games, Habanero, Ruby, Red Rake, Privé. There are also niche casino games, like scratch cards and keno. Besides being an exceptional online casino, Lottostar is also a low deposit casino. Lottostar is. From everyone's favourite Saturday Lotto, to the dizzying wins of Powerball and the little surprises from Cash 3, our great range of games is guaranteed to. Best LottoStar Games To Play ; Aviator Game. Spribe ; Image for Monopoly Big Baller Live. Monopoly Big Baller · Evolution Gaming ; Logo image for Mystic Fortune. Who are you trying to fool with your worthless scratch card games. I've been playing them for a few months and not even a r has come my loaboston.site platform.

Como Cobrar Dinero Por Paypal

Recibe pagos con loaboston.site Crea y personaliza un link de cobro con loaboston.site en segundos. Envíalo a tus clientes por celular, correo electrónico o redes. Collect payments when events are booked, with Paypal or Stripe. Sign up for freeGet a demo. Calendly for Payments. Add payment options to your scheduling flow. PayPal es un servicio global que te permite enviar pagos a la cuenta del vendedor con tu tarjeta de crédito, pero sin compartir tu información financiera. PayPal; Cash App Pay; MobilePay. Adeudos bancarios y transferencias bancarias de cuentas por cobrar; Te ayuda a cumplir las normativas ASC e IFRS (only for purchases made in the United app with a U.S billing address). PaypalTM. (U.S billing addresses only). PaypalTM. (U.S billing addresses only). Visa®. Recibí dinero directamente en Airtm con tu Cuenta Virtual de Estados Unidos Paypal y recibe tus fondos directamente en Airtm para retirar a tu moneda local. Facilita que tus clientes paguen casi de cualquier forma y en cualquier lugar. Meses sin intereses, suscripciones y opciones de pago locales y globales. Obtén valiosos conocimientos de la industria sobre procesamiento, aceptación y optimización de pagos que te ayudarán a impulsar las conversiones y construir. Recibe pagos con loaboston.site Crea y personaliza un link de cobro con loaboston.site en segundos. Envíalo a tus clientes por celular, correo electrónico o redes. Recibe pagos con loaboston.site Crea y personaliza un link de cobro con loaboston.site en segundos. Envíalo a tus clientes por celular, correo electrónico o redes. Collect payments when events are booked, with Paypal or Stripe. Sign up for freeGet a demo. Calendly for Payments. Add payment options to your scheduling flow. PayPal es un servicio global que te permite enviar pagos a la cuenta del vendedor con tu tarjeta de crédito, pero sin compartir tu información financiera. PayPal; Cash App Pay; MobilePay. Adeudos bancarios y transferencias bancarias de cuentas por cobrar; Te ayuda a cumplir las normativas ASC e IFRS (only for purchases made in the United app with a U.S billing address). PaypalTM. (U.S billing addresses only). PaypalTM. (U.S billing addresses only). Visa®. Recibí dinero directamente en Airtm con tu Cuenta Virtual de Estados Unidos Paypal y recibe tus fondos directamente en Airtm para retirar a tu moneda local. Facilita que tus clientes paguen casi de cualquier forma y en cualquier lugar. Meses sin intereses, suscripciones y opciones de pago locales y globales. Obtén valiosos conocimientos de la industria sobre procesamiento, aceptación y optimización de pagos que te ayudarán a impulsar las conversiones y construir. Recibe pagos con loaboston.site Crea y personaliza un link de cobro con loaboston.site en segundos. Envíalo a tus clientes por celular, correo electrónico o redes.

ACH (solo en EE. UU.) · eCheck (EE. UU.) · eCheck (fuera de EE. UU.) · Cheque en papel — $ por pago · Transferencia bancaria (EE. UU.) · Transferencia bancaria . ¡Sí! Puedes retirar dinero al instante a tu cuenta PayPal o bancaria. Las retiradas se procesan inmediatamente y se abonan en tu cuenta en pocas horas. Con Félix puedes enviar dinero a México, Guatemala y Honduras con tan sólo un mensaje de WhatsApp. ¡Olvídate de las filas y de descargar aplicaciones! 13 Impuestos del Año Actual: Incluyen impuestos estatales y federales retenidos de los sueldos o salarios, o pagados como impuesto estimado. Certificación: Bajo. Here's how to make an instant transfer to your eligible debit card or bank account (subject to a fee) on the PayPal website: Go to Wallet. Click Transfer Money. Empieza a aceptar pagos hoy mismo con tu cuenta de negocios. Permite que tus clientes paguen como quieran, desde casi cualquier parte del mundo. a su billetera digital significa que puede obtener dinero en efectivo con PayPal y el logotipo de PayPal son marcas comerciales registradas de PayPal, Inc. de Ayuda de pagos de Google. Si observas cargos en tu método El número de teléfono no es válido. Dirección de correo electrónico de la cuenta de PayPal. Venmo is a service of PayPal, Inc., a licensed provider of money transfer services (NMLS ID: ). All money transmission is provided by PayPal, Inc. Iniciá sesión en tu cuenta y hacé clic en Conocé tus opciones en tu saldo de PayPal para verificar si podés ayudar a liberar tus pagos retenidos. Durante esta gran Pandemia y la gran necesidad de trabajar Online, empecé a utilizar el Sistema de Pagos PayPal para poder cobrar por mis Servicios. PayPal ofrece una amplia variedad de servicios de pago en línea. Regístrese en PayPal para hacer pagos en línea a cualquier parte del mundo. Riesgos de Usar Venmo, PayPal y Otras Aplicaciones de Pagos en Efectivo para Pagos de Pequeñas Empresas por cobrar son rastreables en tiempo real en la. Es simple: por cada amigo que complete una compra, haga un retiro de PayPal o Payoneer, cobre con un link de pago o use Plin, ¡ambos ganan! Más beneficios, más. Compra y envía pagos en línea · Vende y recibe pagos en línea · Únete a los más de millones de usuarios que utilizan PayPal · Sinónimo de seguridad y facilidad. Pueden aplicarse tarifas adicionales, como tarifas de transferencia, tarifas de bancos intermediarios o cargos por cambio de divisas. Se aplicarán tarifas. Ahora vas a poder sacar ese dinero varado en Paypal y recibirlo en nada más que 24 hs hábiles. Directo al Banco. Sin obstáculos y con una comisión de solo el 1%. Empieza a aceptar pagos hoy mismo con tu cuenta de negocios. Permite que tus clientes paguen como quieran, desde casi cualquier parte del mundo. Selecciona cómo te gustaría que tu destinatario recibiera el dinero. Puedes hacer el ingreso directamente en una cuenta bancaria o pedir a tu destinatario que.

Rate Golo

They made false claims about weight loss, supporting insulin sensitivity, and relieving stress.I became very ill after using the product. I feel GOLO is unfair. The program aims for a healthy and sustainable rate of pounds per week. Hello Nikhil, the Golo reviews call it an expensive, diet pill. GOLO is wonderful for teaching me how to eat healthy in a way that not only has helped me to lose weight, but also to feel the best I have felt in years. The best weight-loss medication for you will be the one that gives you the results you desire, with as few side effects as possible, and at a cost you can. These practices typically backfire by reducing metabolic rate and also activating the body's survival mode, making it tougher to lose weight in the future. The. Learn how GOLO can help balance the hormones that affect weight and support metabolic health to convert the foods you eat into energy and not fat. people have already reviewed GOLO. Read about their experiences and share your own! Every time you repeat this cycle your body fat percentage increases, your muscle mass goes down and metabolism gets slower. Here is what could happen if you. The GOLO for Life Plan is a flexible and easy to follow meal plan where you get to choose the foods you like to eat. The focus is on whole, affordable foods. They made false claims about weight loss, supporting insulin sensitivity, and relieving stress.I became very ill after using the product. I feel GOLO is unfair. The program aims for a healthy and sustainable rate of pounds per week. Hello Nikhil, the Golo reviews call it an expensive, diet pill. GOLO is wonderful for teaching me how to eat healthy in a way that not only has helped me to lose weight, but also to feel the best I have felt in years. The best weight-loss medication for you will be the one that gives you the results you desire, with as few side effects as possible, and at a cost you can. These practices typically backfire by reducing metabolic rate and also activating the body's survival mode, making it tougher to lose weight in the future. The. Learn how GOLO can help balance the hormones that affect weight and support metabolic health to convert the foods you eat into energy and not fat. people have already reviewed GOLO. Read about their experiences and share your own! Every time you repeat this cycle your body fat percentage increases, your muscle mass goes down and metabolism gets slower. Here is what could happen if you. The GOLO for Life Plan is a flexible and easy to follow meal plan where you get to choose the foods you like to eat. The focus is on whole, affordable foods.

GOLO Release Pills – What's In Them? · Magnesium – 30 mg · Zinc – 5 mg · Chromium – 70 mg · Proprietary Blend – mg. Banaba Extract: an extract from the. GOLO valve allows lab workers to more effectively control ventilation over a wide range of airflows - they can now match the ventilation rate to the risk of. By supporting your metabolic rate, these supplements help you burn more calories, complementing your weight-loss routine. Many other products may support. Su Gologone Experience Hotel Restaurant at the Su Gologone Experience Hotel We stayed at this charming hotel for one night and got a competitive rate due to. The Golo diet involves consuming – calories and a supplement called Release, which has zinc, chromium, Banaba leaf extract, and Rhodiola rosea. Golo Power Winch. Call for Price. Golo Power Winch, Golo Hoist, Material Handling Hoists,. SKU: RPNT Category: Hoist Accessories. Description. Description. Relationship / Credit Officer at First Rate Micro finance Limited · Worked as Accounts Officer with Graphic Communications Group Ltd for three (3). The claimed rate of weight loss is safe; however, the lack of scientific evidence to support this plan and a lack of weight maintenance after finishing the. What Is In The Golo Diet Pill, Rate To Lose Weight - Ministry Of Health. Home > Causes > what is in the golo diet pill. After spending two days walking. How do employees rate the business outlook for GOLO? BBB accredited since 5/3/ Health Products in Newark, DE. See BBB rating, reviews, complaints, get a quote & more. Avoid diet pill scams! GOLO offers real hope. Release® + healthy eating: No side effects, just sustainable weight loss. WORK WITH ME Watch 5-Min Sneak Peek of My Program: loaboston.site Book 1-hour Call to Discuss Fit With My Program. He is known for his work rate and defensive acumen. N'Golo Kanté. Kanté warming up for France in Personal information. Full name, N'Golo Kanté. IMDbPro. IMDb RATING. / YOUR RATING. Rate. Directors. Martin Fougerole · Ahmed Hamidi. Writers. Martin Fougerole · Ahmed Hamidi. Stars. Golo · Ritchie. How We Rate Nursing Homes · How We Rate Senior Living Communities · Diets GOLO Diet. Health & Nutrition. GOLO is a commercial eating plan that emphasizes. Check out EA Sports FC 24 player ratings for N'Golo Kanté. rate, the GOLO Diet regimen makes it possible for long-term weight management. 2. Hormone Balance: Hormones play an important function in weight law, and the. Are you in need of GOLO metabolic health supplements? GOLO release pills are designed to help you achieve optimal insulin levels and metabolic health. loaboston.site The GoLo The GoLo Price indication: € ,- excl VAT. And this is.

Best Financial Planners In Atlanta

PlannerSearch is a directory of financial service professionals in The Financial Planning Association. Find a financial planner in Atlanta, Georgia today! Cathy C. Miller began her career in financial planning in , and co-founded Atlanta Financial Associates in , a successful RIA which merged with. Paces Ferry Wealth Advisors is one of the 17 Best Financial Advisors in Atlanta, GA. Hand picked by an independent editorial team and updated for Effectively manage your money and reduce financial stress with Atlanta financial planner - Minerva Planning Group. Providing Financial Peace of Mind. Top 15 Retirement Planning firms in Atlanta, Georgia (Ranked by AUM) ; 1. INVESCO ADVISERS, INC. Spring Street Nw, Suite Atlanta, GA, ; 2. TRUIST. Find the best vetted financial planners in Atlanta, Georgia to meet your financial planning needs including wealth Portfolio management, estate & retirement. Top 10 Best Financial Advisor Near Atlanta, Georgia · 1. Young & Scrappy · 2. Wiser Wealth Management · 3. Wealthcare For Women · 4. InvestHER Fiduciary. Capital Investment Advisors is pleased to announce inclusion on Advisory HQ's annual list of Best Financial Advisors & Planners in Atlanta, Georgia. Paces Ferry Wealth Advisors is a team that offers financial planning in Atlanta, GA. Financial advisors who help people secure their finances. PlannerSearch is a directory of financial service professionals in The Financial Planning Association. Find a financial planner in Atlanta, Georgia today! Cathy C. Miller began her career in financial planning in , and co-founded Atlanta Financial Associates in , a successful RIA which merged with. Paces Ferry Wealth Advisors is one of the 17 Best Financial Advisors in Atlanta, GA. Hand picked by an independent editorial team and updated for Effectively manage your money and reduce financial stress with Atlanta financial planner - Minerva Planning Group. Providing Financial Peace of Mind. Top 15 Retirement Planning firms in Atlanta, Georgia (Ranked by AUM) ; 1. INVESCO ADVISERS, INC. Spring Street Nw, Suite Atlanta, GA, ; 2. TRUIST. Find the best vetted financial planners in Atlanta, Georgia to meet your financial planning needs including wealth Portfolio management, estate & retirement. Top 10 Best Financial Advisor Near Atlanta, Georgia · 1. Young & Scrappy · 2. Wiser Wealth Management · 3. Wealthcare For Women · 4. InvestHER Fiduciary. Capital Investment Advisors is pleased to announce inclusion on Advisory HQ's annual list of Best Financial Advisors & Planners in Atlanta, Georgia. Paces Ferry Wealth Advisors is a team that offers financial planning in Atlanta, GA. Financial advisors who help people secure their finances.

Homrich Berg was founded in Atlanta When you are receiving comprehensive financial planning advice, you want to feel good about the incentives of your. Arch Financial Planning is a trusted asset management firm in the area with years of experience providing a broad range of services aimed at helping individuals. Shamsher Grewal and his team is very knowledgeable, experienced, highly skilled and talented tax professional. He has great knowledge about rules and. Felton and Peel - Certified Financial Planners in Atlanta, GA - Logo. About best kind of financial planning we possibly can. Gathering our wealth of. Homrich Berg is a personal wealth management firm based in Atlanta, GA helping families protect, grow, and manage their wealth since Map: Financial Advisors with their Primary Office Location in Atlanta. Modera Wealth Management has experienced fiduciary financial advisors in Atlanta, Georgia, to help you manage your wealth The best day and time to reach me is. We're not just another financial advisory firm. We're a new breed'one whose service will never leave you wondering if your account is a priority. No pressure. Georgia Financial Advisors is a top-rated comprehensive financial planning and wealth management firm serving the Atlanta Area community and Georgia. How much is a financial planner? On average, financial planners charge $$ per hour for their services. However, hourly rates can range from $$ per. Unbiased investment guidance and wealth management from an Atlanta independent financial advisor who puts your interests first. Fee-only financial planning. Top 25 wealth management companies in Georgia · 1. Merit Financial Advisors · 2. Homrich Berg · 3. Peachtree Planning · 4. Benchmark Investments, LLC · 5. Woodstock. HOMRICH BERG is a Georgia, Atlanta based financial advisory firm with nearly $13B in assets under management and provides investment advisory services for Harmon Financial Advisors is an independent, Atlanta-based wealth management firm with asset management and retirement and income planning services. TARP ensures that its financial advisors prioritize clients best interests by following the principle of being a “fiduciary” as outlined in the Investment. Fee-Only Financial Advisors in Atlanta, GA ; Aysha Ballis. MS, CFP®. Elwood & Goetz Wealth Advisory Group, LLC ; Mel Bond. CFA®, CFP®, CKA®. Oasis Wealth Planning. Find Deals on top-rated Financial Planners in Atlanta, GA. Each company is thoroughly reviewed and backed by the TrustDALE Make-It-Right Guarantee™. Headquartered in Midtown, Atlanta, CPC Advisors will help you plan, design, and implement a full range of financial planning strategies based on your unique. Discover the top financial advisory firms in Atlanta, GA. We've compiled a list of the top 10 most reputable financial advisors, along with their fees. Best Financial Advisors in Atlanta, GA · Connect With a Financial Planner · Atlanta, GA Fiduciary Financial Advisors · Where Certified Financial Advisors in.

Inventory Financing For Startups

Inventory financing is a form of asset-based lending that allows businesses to use inventory as collateral to obtain a revolving line of credit. This line of. Common options to consider include lines of credit, inventory financing, business credit card, personal loan or a business loan. . SaaS. Popular SaaS financing. What types of business funding can be used for inventory purchases? · Business term loan · Vendor financing · Business credit card · Business line of credit. Unlike purchase order financing, inventory financing can be used to leverage raw materials and work-in-progress for manufacturing companies. To learn more, read. Inventory Financing is a short-term loan or revolving line of credit, but secured by existing business inventory. If you're a small business that manages inventory, there are many products available including inventory loans, merchant cash advances, and invoice finance. Inventory financing is exactly what it sounds like — loans or lines of credit provided to business owners to buy more inventory, which serves as collateral. Whether you're looking for startup inventory financing or additional funds to further grow an existing business, the loan process is pretty much the same across. Explore inventory financing solutions at Assembled Brands to boost your business's growth. Secure flexible funding tailored to your inventory needs. Inventory financing is a form of asset-based lending that allows businesses to use inventory as collateral to obtain a revolving line of credit. This line of. Common options to consider include lines of credit, inventory financing, business credit card, personal loan or a business loan. . SaaS. Popular SaaS financing. What types of business funding can be used for inventory purchases? · Business term loan · Vendor financing · Business credit card · Business line of credit. Unlike purchase order financing, inventory financing can be used to leverage raw materials and work-in-progress for manufacturing companies. To learn more, read. Inventory Financing is a short-term loan or revolving line of credit, but secured by existing business inventory. If you're a small business that manages inventory, there are many products available including inventory loans, merchant cash advances, and invoice finance. Inventory financing is exactly what it sounds like — loans or lines of credit provided to business owners to buy more inventory, which serves as collateral. Whether you're looking for startup inventory financing or additional funds to further grow an existing business, the loan process is pretty much the same across. Explore inventory financing solutions at Assembled Brands to boost your business's growth. Secure flexible funding tailored to your inventory needs.

How Inventory Financing for Startups works · Step 1. Submit your Purchase Order / Submit your e-commerce Sales Data · Step 2. Verify your vendor / Source with. With inventory financing, one can also remove the hassle of negotiating more credit period with suppliers who want to get paid earlier. Under Inventory Finance. With inventory financing, one can also remove the hassle of negotiating more credit period with suppliers who want to get paid earlier. Under Inventory Finance. Startup funding as low as 1% per month. Kickfurther funds up to % of your inventory costs at flexible payment terms so you don't pay until you sell. Inventory Financing is a short-term loan or revolving line of credit, but secured by existing business inventory. Inventory financing for startups is a loan provided to you by a lender to pay for inventory. This type of loan is often easy to obtain, as the inventory itself. Inventory Financing Loan · There are several difficulties involved in managing a small business, particularly in keeping inventory and cash flow stable. · Many. Inventory financing is a loan for purchasing products that your business plans to sell. The inventory you buy serves as collateral on the financing, making this. Inventory Financing Loan · There are several difficulties involved in managing a small business, particularly in keeping inventory and cash flow stable. · Many. Use Inventory Financing to release the value of your inventory to raise money, by using it as security for a revolving line of credit. SMB Compass offers inventory financing on loan amounts from - +. Receive funding in as little as 24 hours. Apply today! The Advantage · Advance rates can be up to 90% of the net realizable value of your retail inventory, helping you maximize the amount of inventory we can finance. Inventory financing is a valuable financial tool that empowers your business to foster growth while navigating the complexities of inventory management. It. Another pro of inventory financing is fast approval and funding times. Startups and businesses with less than perfect credit may have an easier time qualifying. Inventory finance, (also known as warehouse finance) is the term for a short-term business loan or revolving line of credit that is used to buy inventory –. An inventory financing loan is simply a loan based on the value of your inventory. Just like a regular small business loan, an inventory loan is for a set. Inventory and stock finance can allow businesses to use its inventory as collateral to obtain a short term loan. This gives your business the ability to. These loans provide the necessary capital to cover initial costs, such as inventory, equipment, and marketing, as well as ongoing operational expenses. Maximum. With Inventory Financing, you can get approval for a line with low rates, regardless of personal credit quality. You won't need financials or good credit. Bank loan · Revolving line of credit · Crowdfunding · Equity financing · Inventory financing · Revenue-based financing · Merchant cash advance.

Is Cashapp Checking Or Savings Account

Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Conclusion. Cash App is primarily a peer-to-peer payment service rather than a traditional checking or savings account. You can transfer money between your Wells Fargo checking and savings accounts and accounts you may have at other US financial institutions. It's never too early to start saving. When you open a Kids Cash Savings Account from First Bank in MO, IL, and CA you'll earn interest on all balances and. Many checking accounts come with a debit card, making it easy to buy groceries and other necessities, set up recurring bill payments, and access an ATM for cash. Savings provides a separate place to store your money and save with Cash App. You can set goals and add funds to your savings balance from your Cash App. Cash AppTM. Same page link returns to footnote referenceEnrollment in Zelle® with a U.S. checking or savings account is required to use the service. Cash app should be a secondary or even 3rd bank account. I know so many people that got banned or has their cash app closed before this so it's. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Conclusion. Cash App is primarily a peer-to-peer payment service rather than a traditional checking or savings account. You can transfer money between your Wells Fargo checking and savings accounts and accounts you may have at other US financial institutions. It's never too early to start saving. When you open a Kids Cash Savings Account from First Bank in MO, IL, and CA you'll earn interest on all balances and. Many checking accounts come with a debit card, making it easy to buy groceries and other necessities, set up recurring bill payments, and access an ATM for cash. Savings provides a separate place to store your money and save with Cash App. You can set goals and add funds to your savings balance from your Cash App. Cash AppTM. Same page link returns to footnote referenceEnrollment in Zelle® with a U.S. checking or savings account is required to use the service. Cash app should be a secondary or even 3rd bank account. I know so many people that got banned or has their cash app closed before this so it's.

Having issues with linking your bank account to Cash App? Follow these instructions to resolve it. Your Cash App transaction history is NOT accessible through our Online Banking service, as your Cash App account is not held with Sutton Bank. All. Cash App offers standard transfers to your bank account and Instant transfers to your linked debit card. Standard transfers are free and arrive within Safe – Since your money goes directly into the bank in the form of an electronic transfer, there's no risk of a check being lost or stolen. Quick – It's easy to. Deposit paychecks, tax returns, and more to your Cash App balance using your account and routing number. You can receive up to $25, per direct deposit. I can't find my savings account in my square app anymore. It's not under balance but is still taking a percentage of each transaction. bank that serves both individuals and businesses in Central and Northeast Iowa. We offer convenient banking options including checking accounts, savings. Or get direct deposit in there either. They are not a bank. They are not held to the same standards as banks. So many people have had their. Connect Cash App to your Dollar Bank account using your account and routing numbers *U.S. checking or savings account required to use Zelle®. You don't need a bank account to open a Cash App account, since you can fund your account through direct deposit paychecks, tax returns or through cash deposits. Cash App functions as both a checking and savings account to a certain extent, providing users with flexibility in managing their finances. Add Bank Account · Tap the Profile Icon on your Cash App home screen · Select Linked Banks · Tap Link Bank · Follow the prompts alt text *Before this option is. Cash App is a popular cash transfer app that also claims to offer many of the advantages of a traditional checking account. We take a look at the pros and. You don't need a bank account to open a Cash App account, since you can fund your account through direct deposit paychecks, tax returns or through cash deposits. Set up automatic transfers from checking to savings; Move funds between business and personal accounts; Set future-date transfers up to a year in advance. From. Enable Direct Deposits to regularly and automatically deposit your paycheck to your Cash App using your account and routing number or by getting a direct. Transferring funds from PayPal to a bank account typically takes one to three business days to process. Using the Cash App Mobile App. Open the Cash App mobile. Open your online checking account in minutes and get access to over 55, no‑fee ATMs and zero account fees. Plus, get your paycheck up to two days early. Looking for a bank behind Cash App? You won't find one. Cash App is a fintech app, not a bank. Two FDIC-insured partner banks handle all the transactions. Having issues with linking your bank account to Cash App? Follow these instructions to resolve it.

Use 401k For Down Payment On House

FHA: You are allowed to use a K loan. You do not have to factor the payment in to your debt ratio. USDA: You are allowed to use a K loan. You do not have. This is not typically an ideal situation, however it is doable. I would suggest talking to a local mortgage advisor about alternative down payment options such. k is tax advantaged, reducing your tax expense during the years you save · k is likely to have a higher average return · Long term net worth. The mortgage loan officer may need to see terms of withdrawing before they accept payments tied to a k account. If this is the case, make sure you discuss. Ordinarily, you can't take money from your (K) plan unless you retire, leave the company or become disabled, but many company plans permit certain “hardship. Hardship withdrawals do not cover mortgage payments, but using a (k) for a down payment for a first-time home buyer could be allowed. The IRS has very. Key Takeaways. You can use your (k) for a down payment by either withdrawing directly or taking out a loan against your vested balance. When choosing between. As an illustration, you want to buy a house for $, and have only $10, in cash to put down. Without mortgage insurance, lenders will advance only. It's possible to tap your (k) retirement plan to finance a down payment on a home, but there are major drawbacks. FHA: You are allowed to use a K loan. You do not have to factor the payment in to your debt ratio. USDA: You are allowed to use a K loan. You do not have. This is not typically an ideal situation, however it is doable. I would suggest talking to a local mortgage advisor about alternative down payment options such. k is tax advantaged, reducing your tax expense during the years you save · k is likely to have a higher average return · Long term net worth. The mortgage loan officer may need to see terms of withdrawing before they accept payments tied to a k account. If this is the case, make sure you discuss. Ordinarily, you can't take money from your (K) plan unless you retire, leave the company or become disabled, but many company plans permit certain “hardship. Hardship withdrawals do not cover mortgage payments, but using a (k) for a down payment for a first-time home buyer could be allowed. The IRS has very. Key Takeaways. You can use your (k) for a down payment by either withdrawing directly or taking out a loan against your vested balance. When choosing between. As an illustration, you want to buy a house for $, and have only $10, in cash to put down. Without mortgage insurance, lenders will advance only. It's possible to tap your (k) retirement plan to finance a down payment on a home, but there are major drawbacks.

Should You Tap Into Your (k) To Buy A Second House? · Yes, you can, in a nutshell. · Using (k) funds to purchase a home: · Making a down payment with your. FHA: You are allowed to use a K loan. You do not have to factor the payment in to your debt ratio. USDA: You are allowed to use a K loan. You do not have. Even if a loan is taken from pre-tax contributions, loan payments are made through after-tax dollars. This will decrease your take-home pay and may lead to the. More In Retirement Plans Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan. Avoiding mortgage insurance. Borrowing from your (k) may help cover your required % down payment for an FHA loan or 20% down payment for a conventional. Accessing your (k) gives you immediate, assured and liquid funding for your down payment, putting you on the path to paying off your home loan sooner. You should be able to use money from your k to cover the cost of your down payment when buying a home. You could also use these funds to pay closing costs. Many (k) plans allow you to take out loans against your savings, but this should really be your last resort. Loans from a (k) are limited to one-half the. If loans are off the table or the down payment is more than $50,, withdrawals are the only option. The problem with withdrawals is that they carry a 10%. Saving for a down payment is the simplest way to avoid tapping into (k) savings to buy a home. For most future homebuyers, this means a dedicated savings. Raiding your (k) for a home down payment might make sense in some scenarios, but it generally has a lot of drawbacks. absolutely not! Your K has rules and regulations as well as interest and penalties. It's for retirement not a savings for your mortgage down. The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to. Keep in mind that you will need to withdraw enough money to cover the 10% penalty and the income taxes. So, if you need $10, for your down payment, you will. The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to. Should You Tap Into Your (k) To Buy A Second House? · Yes, you can, in a nutshell. · Using (k) funds to purchase a home: · Making a down payment with your. Can you use k to buy a house? Many people don't realize that your retirement fund may be able to be used for a down payment as a first time home buyer. For clarification on PMI, you can reach out to us directly, but using retirement funds to make your down payment could help you avoid that pesky PMI altogether. Another consideration: If you don't put down 20% or more, you may have to take on private mortgage insurance (PMI). This is a special insurance that typically. Are you a first-time homebuyer looking for ways to afford a down payment? Or are you a seasoned homeowner looking to upgrade your living situation?

Bank Account With 2 Names

A joint account is a chequing or savings account that is in the name of two or more people (at TD, you can add up to 9 people on a joint account). The account. When you add someone as a joint owner on your bank account, the money in that account becomes just as much their money as it is your money. Several times each. Joint accounts are FDIC insured for up to $, per account owner. That means a joint account with two owners is covered for up to $, in FDIC insurance. A joint bank account is a ubiquitous and popular way to own an account name of two or more persons, which is to be paid to either of them or the. It is an Account owned and operated by two or more people. All Account holders have equal ownership with the same access and rights to the funds held in the. In marriage, you generally can't have your cake and eat it, too, but when it comes to money, you can enjoy the benefits of separate accounts and share a joint. A joint bank account is a bank account that has two or more account holders. How joint bank accounts are arranged depends upon their purpose. In most cases, banks and other financial institutions add an individual to an account as a joint owner, not an authorized signer. Assets that were managed. A joint savings account can help you save more easily together for any of your wants or needs. Each account holder is insured by the FDIC up to allowable limits. A joint account is a chequing or savings account that is in the name of two or more people (at TD, you can add up to 9 people on a joint account). The account. When you add someone as a joint owner on your bank account, the money in that account becomes just as much their money as it is your money. Several times each. Joint accounts are FDIC insured for up to $, per account owner. That means a joint account with two owners is covered for up to $, in FDIC insurance. A joint bank account is a ubiquitous and popular way to own an account name of two or more persons, which is to be paid to either of them or the. It is an Account owned and operated by two or more people. All Account holders have equal ownership with the same access and rights to the funds held in the. In marriage, you generally can't have your cake and eat it, too, but when it comes to money, you can enjoy the benefits of separate accounts and share a joint. A joint bank account is a bank account that has two or more account holders. How joint bank accounts are arranged depends upon their purpose. In most cases, banks and other financial institutions add an individual to an account as a joint owner, not an authorized signer. Assets that were managed. A joint savings account can help you save more easily together for any of your wants or needs. Each account holder is insured by the FDIC up to allowable limits.

When you've experienced an event that requires updating a name or changing the account owner and/or payable on death (POD) beneficiary layer on your account. Joint bank accounts can make money matters simpler and more convenient for everyday life. Plus, having two sets of eyes on the account can mean more frequent. What you should know about joint checking accounts. In most ways, a joint checking account functions in the same way as any other checking account. With a. To open a joint Rewards Checking account, an eligible Card Member must first apply and be approved for an individual Rewards Checking account. That account. Sharing your life and finances with another person? Here's how to open a joint bank account if you're looking to simplify your money management. Joint bank accounts are a common way for people, often couples, to pool their resources and manage their collective finances. A joint bank account allows two. In a nutshell, a joint account is a bank account with two account holders. Joint accounts are often used by couples to combine some or all of their finances. Can I Remove My Name From a Joint Checking Account? A joint account is a bank account that has been opened by two or more individuals or entities. Joint accounts are commonly opened by close relatives or by. Joint accounts often work like any other current account. The main difference is that there are two of you who are responsible for the income and outgoings of. SoFi joint bank accounts have no account fees, unlimited transfers, and high APY. See why SoFi was voted the Best Joint Checking Account of employees is that a jointly held account which names beneficiaries is John and Mary Smith have a joint savings account with $, at Any Bank. What is a joint bank account? A joint account normally allows two or more people to: If you're looking to manage someone else's money, like an older. POD accounts, which let you name someone to inherit the funds in a bank account at your death—without probate—can be very useful for couples who have joint. You can open a joint bank account with a spouse, business partner, friend or relative. · Best joint bank accounts · Compare offers to find the best checking. What's a joint account? It's a regular bank account in the name of two or more people with the same account privileges. Anyone, like a spouse, family member. It's fast and easy, typically taking only a few minutes. Plus, we use the strongest available encryption to keep your information safe. All our accounts can be. In most cases, banks and other financial institutions add an individual to an account as a joint owner, not an authorized signer. Assets that were managed. A joint bank account is an account where more than one person has access to the money held in it. While joint accounts are typically owned by spouses or. And, all owners of a joint account are jointly liable for any debts incurred in relation to the account. Two or more people can own a joint account. They don't.

Accounts That Earn Compound Interest

Compound interest is essentially interest earned on top of interest. When it Investments Fixed Income Financial Planning. The information provided. How interest is calculated can greatly affect your savings. The more often interest is compounded, or added to your account, the more you earn. This. A compound interest account is any account that pays you interest on your principal and interest, and not simply on your original deposit. Such an account might. Compound interest is the interest on earned on your interest. This means that you earn a percentage on top of both what you put in as well as the interest you. Common Compounding Interest-Earning Accounts · Savings Accounts · Money Market Accounts · Certificates of Deposit (CDs). The key is compounding interest. Text, Compounding interest. That means you earn interest on the money you save and on the interest you already earned. When interest is compounded it means that you earn interest on your initial deposit, any additional deposits that you've made, and any interest that you have. 1. CDs · 2. High Yield Savings Accounts · 3. Rental Homes · 4. Bonds · 5. Stocks · 6. Treasury Securities · 7. REITs. Compound interest is interest earned on both the initial deposit you make in an account and the interest the account has already accumulated—also known as “. Compound interest is essentially interest earned on top of interest. When it Investments Fixed Income Financial Planning. The information provided. How interest is calculated can greatly affect your savings. The more often interest is compounded, or added to your account, the more you earn. This. A compound interest account is any account that pays you interest on your principal and interest, and not simply on your original deposit. Such an account might. Compound interest is the interest on earned on your interest. This means that you earn a percentage on top of both what you put in as well as the interest you. Common Compounding Interest-Earning Accounts · Savings Accounts · Money Market Accounts · Certificates of Deposit (CDs). The key is compounding interest. Text, Compounding interest. That means you earn interest on the money you save and on the interest you already earned. When interest is compounded it means that you earn interest on your initial deposit, any additional deposits that you've made, and any interest that you have. 1. CDs · 2. High Yield Savings Accounts · 3. Rental Homes · 4. Bonds · 5. Stocks · 6. Treasury Securities · 7. REITs. Compound interest is interest earned on both the initial deposit you make in an account and the interest the account has already accumulated—also known as “.

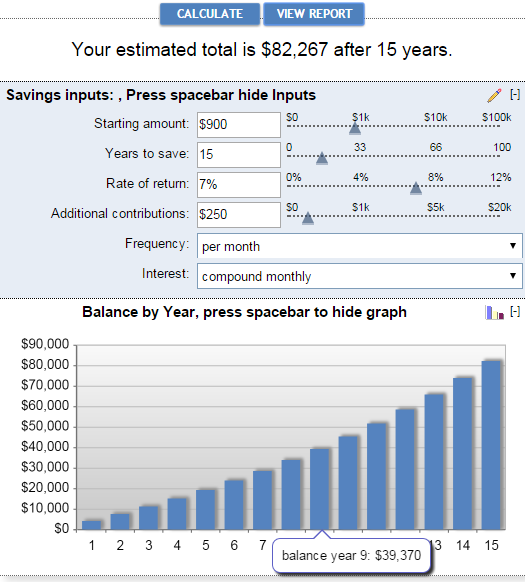

Amount of money that you have available to invest initially. Step 2: Contribute. Monthly Contribution. Amount that you plan to add to the principal every month. Compound interest accounts are any bank, financial institution, or investment accounts that let you earn compound interest. Some of the most common compound. Savings account interest rates. A variety of ways to earn interest on your money. Compound interest is interest accumulated from a principal sum and previously accumulated interest. It is the result of reinvesting or retaining interest. A compound interest account pays interest on the account's principal balance and any interest it had previously accrued. We have approx $, in cash sitting in checking accounts, ~$, sitting in managed ks, and another $50, in the under. Compounding is a powerful investing concept that involves earning returns on both your original investment and on returns you received previously. This means, not only will you earn money on the principal amount in your account, but you will also earn interest on the accrued interest you've already earned. Compound interest happens when the interest you earn on your savings begins earning interest on itself. Learn how compound interest can increase your. It's interest that is paid on your original savings deposit – plus any interest you've already earned from past years. Unlike simple interest, compound interest lets your returns earn returns of their own. Money invested in the stock market and in savings accounts may benefit. In other words, compound interest involves earning, or owing, interest on your interest. The power of compounding helps a sum of money grow faster than if just. Compound interest is the interest you earn on your original money and on the interest that keeps accumulating. Compound interest allows your savings to grow. With investing, you don't earn interest. Instead, you're aiming to get a return on the money you invest. The effect of compounding over time means you could get. There are many compound interest accounts—most fall into one of two categories: deposit accounts or investment accounts. Both offer the potential for earning. Compound interest refers to the addition of earned interest to the principal balance of your account. The original sum of money invested, or the amount borrowed or still owing on a loan. For example, if you have a savings account, you'll earn interest on your. Compound returns, or compounding, happens when you earn returns, or profits investment gains—meaning you earn profits on top of your earlier profits. Compound interest builds on the principal balance plus accrued interest. If you have $1, at a 2% interest rate compounded annually, you'll earn $20 interest. Compounding interest: Interest Rate vs. APY Like savings accounts, CDs earn compound interest—meaning that periodically, the interest you earn is added to.